The UK Payments Sector: Innovation, Regulation, and the Road Ahead

With over 1,200 firms and around 20,000 agents, the UK payments sector is vast. Add in a growing network of distributors and approximately 50 crypto firms (with increasing overlap between crypto and payments) and you’ve got a complex, fast-evolving ecosystem of essential services and innovation.

There’s no doubt this is an exciting, rapidly changing sector that plays a central role in our financial lives. And as the FCA puts it, “payments are important.”

Last week’s FCA webinar on Payments Strategy and Consumer Duty was a timely reminder that regulatory expectations are rising fast. Firms that fall short may not get a second chance. But the FCA is clear it wants to work with firms to help them succeed and grow.

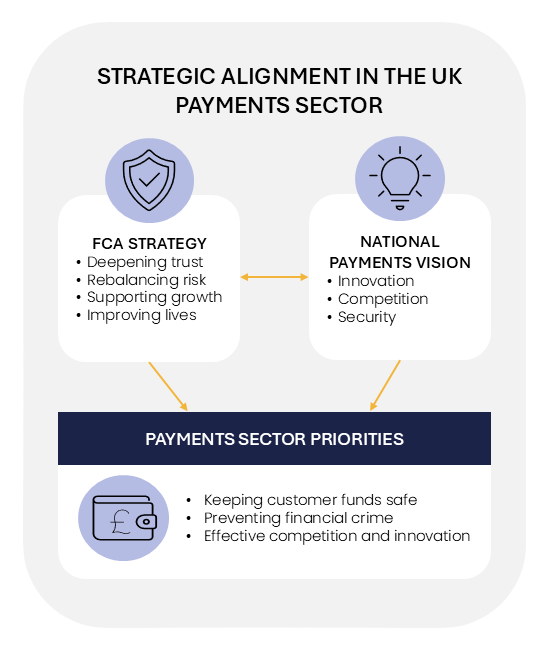

The FCA’s updated strategy aligns with its broader goals and the New Payments Vision. The message is clear: payments must be innovative, safe, competitive, and crucially understood and trusted by consumers. The core priorities remain:

Keeping Customer Funds Safe: Protecting and managing funds with integrity.

Preventing Financial Crime: Strengthening defences against fraud and money laundering.

Effective Competition and Innovation: Creating an environment that benefits customers and puts the UK at the forefront of payments sector globally.

These themes were also reflected in the latest Dear CEO letter, which we’ve broken down into a handy regulatory gap analysis to help you assess your firm’s position.

A recurring theme? Governance.

Many issues, from fraud to safeguarding failures, stem from weak oversight and poor challenge at the senior level. The FCA expects leadership teams to be capable, engaged, and accountable, with access to independent challenge – whether through Non-Executive Directors or third-party input. And remember …outsourcing doesn’t outsource responsibility.

As many firms prepare for their second annual Consumer Duty Board meeting, the expectation is that the Duty is now fully embedded. Hopefully, you're seeing the benefits in customer trust and business growth.

One key area of focus is pricing transparency, especially in international payments. The FCA’s message was clear, just because you think your disclosures are clear doesn’t mean your customers understand them. Expect further scrutiny on:

what customers are paying,

why they’re paying it,

and how easily they can compare prices.

This won’t be a tick-box exercise. It’s a test of real consumer understanding.

The FCA reiterated that growth in the sector should not come at the cost of increased financial crime, underscoring its continued focus on financial crime risk management.

The scope is expanding beyond APP fraud to include unauthorised transactions. If your firm submits REP017 data, ensure its accurate and your controls are robust. High fraud rates could trigger immediate supervisory action unless you can demonstrate effective risk management.

The recent safeguarding consultation proposes a CASS-style regime. The FCA has welcomed industry feedback and is working to ensure the rules are proportionate for firms of all sizes. While the Policy Statement may still be a few months away, don’t be surprised if it lands sooner…stay alert.

Recent firm failures have shown that risk management and wind-down planning still need work. Frameworks must address all risks, including group and liquidity risk. Wind-down plans should be realistic, comprehensive, and executable – and closely linked to your risk framework.

The biggest takeaway? The FCA doesn’t like surprises.

If your firm is facing challenges (operational, financial, or regulatory) engage early. The FCA may be able to help. But if the first they hear of a problem is when it’s too late, that opportunity is lost.

In short, compliance isn’t just a protective layer, it’s a strategic advantage. In a sector this large and fast-moving, proactive dialogue with the regulator might be the smartest move you make.

How is your firm preparing for the next phase of regulatory expectations?

Get in touch with us to learn how we can help you stay compliant in this dynamic environment - contact@avyse.co.uk